United States Fraud Detection And Prevention Market Overview

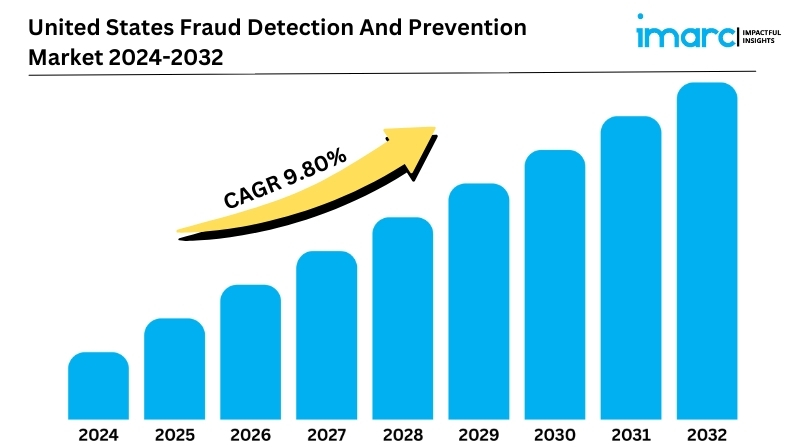

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 9.80% (2024-2032)

The U.S. fraud detection and prevention market is experiencing robust growth driven by several key factors, primarily the increasing incidence of cybercrime and fraud across various sectors. According to the latest report by IMARC Group, The United States fraud detection and prevention market size is projected to grow at a CAGR of 9.80% from 2024 to 2032.

United States Fraud Detection And Prevention Industry Trends and Drivers:

The rapid digitization of services and the widespread adoption of online platforms for banking, e-commerce, and other financial transactions have created new opportunities for fraudsters. As cybercriminals employ more sophisticated techniques, including phishing, identity theft, and financial fraud, the need for advanced fraud detection and prevention solutions has intensified. Businesses and financial institutions are investing heavily in technologies like machine learning, artificial intelligence (AI), and big data analytics to detect and mitigate fraud in real time. These technologies enhance the ability to analyze vast amounts of data quickly, identify unusual patterns, and flag potential fraudulent activities before they cause significant harm. The growing complexity and volume of cyber threats necessitate robust and scalable solutions, driving demand in the fraud detection and prevention market.

Another significant factor propelling the market is the stringent regulatory environment and compliance requirements aimed at combating financial fraud. Regulatory bodies, such as the Financial Crimes Enforcement Network (FinCEN), the Federal Trade Commission (FTC), and the Securities and Exchange Commission (SEC), have established stringent guidelines to ensure that businesses implement effective fraud prevention measures. Compliance with regulations like the Gramm-Leach-Bliley Act (GLBA), the Sarbanes-Oxley Act (SOX), and the Payment Card Industry Data Security Standard (PCI DSS) is mandatory for organizations handling sensitive financial data. These regulations require the deployment of comprehensive fraud detection systems to safeguard customer information and maintain data integrity. Non-compliance can result in hefty fines, legal penalties, and reputational damage, prompting businesses to prioritize investment in fraud detection and prevention technologies.

Moreover, the increasing public awareness of data privacy and security issues has led consumers to demand higher standards of protection from businesses, further driving the market for advanced fraud prevention solutions. Additionally, the proliferation of mobile devices and the Internet of Things (IoT) has expanded the attack surface for cybercriminals, making fraud detection and prevention more challenging and necessary. As more devices connect to the internet, the potential entry points for fraudsters increase, requiring businesses to adopt comprehensive and integrated security solutions. The evolution of cloud computing and the shift towards remote working models have also contributed to the need for enhanced fraud prevention measures. Cloud-based fraud detection solutions offer scalability, flexibility, and cost-efficiency, enabling organizations to adapt to changing threat landscapes quickly. As businesses continue to innovate and embrace digital transformation, the demand for robust fraud detection and prevention solutions will continue to grow, ensuring the security and trust of digital transactions and services.

United States Fraud Detection And Prevention Industry Segmentation:

The report has segmented the market into the following categories:

Component Insights:

- Solution

- Services

Application Insights:

- Identity Theft

- Money Laundering

- Payment Fraud

- Others

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

Vertical Insights:

- BFSI

- Government and Defense

- Healthcare

- IT and Telecom

- Manufacturing

- Retail and E-Commerce

- Others

Regional Insights:

- Northeast

- Midwest

- South

- West

Competitive Landscape: The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=19990&flag=F

| United States Food Preservatives Market |

| United States Hydroponics Market |

| United States Graphene Market |

| United States Self Storage Market |

| United States Fintech Market |

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145