Cooking

How to Cook Delicious Meals Easily

Effortless Gourmet: Simple Steps to Cook Delicious Meals at Home. Discover the joy of cooking with these simple steps to prepare delicious meals that will impress your family and friends. Whether...

15 Jul 2025

Easy Recipes for Quick Weeknight Dinners

Simple and Delicious Weeknight Dinner Ideas for Busy Families. Finding time to prepare a nutritious and delicious dinner during the week can be a challenge for many families. With these easy...

16 Jul 2025

Delicious Dinner Options Under 30 Minutes

Quick and Tasty Dinner Recipes Ready in Under 30 Minutes. Are you tired of spending hours in the kitchen after a long day? You're not alone. Many people struggle to find the time and energy to...

23 Sep 2025

10 Must-Try Recipes for Busy Weeknights

Introduction. Busy weeknights call for quick, delicious, and easy-to-make meals. Whether you're a seasoned chef or a cooking novice, these 10 must-try recipes will save you time and satisfy your...

16 Jul 2025

Communication

Secrets to Mastering Public Speaking Skills

Introduction to Mastering Public Speaking. Public speaking is an essential skill that can significantly impact your personal and professional life. Whether you're delivering a presentation at work, speaking at a conference, or giving a toast at a wedding, the ability to communicate effectively in front of an audience is invaluable. This article will explore expert tips and strategies to help you master public speaking skills and deliver your message with confidence and clarity.. Understand Your Audience. Before you step onto the stage, it's crucial to understand who your audience is. Tailoring your message to meet their interests, knowledge level, and expectations can make your speech... Read More

14 Jul 2025

Finance

Side Hustle Ideas to Increase Your Income

Unlock Your Earning Potential with These Proven Side Hustle Strategies. In today's economy, having multiple streams of income has become more important than ever. Whether you're looking to pay off...

24 Sep 2025

Smart Strategies for Investing in Stocks

Introduction to Stock Market Investing. Investing in the stock market can be a lucrative way to build wealth over time. However, it requires knowledge, strategy, and patience. This guide will...

16 Jul 2025

The Role of Machine Learning in Finance

Introduction to Machine Learning in Finance. Machine learning, a subset of artificial intelligence, has become a cornerstone in the evolution of the financial sector. By leveraging algorithms and...

20 Jul 2025

Financial Planning for Long-Term Security and Peace

Why Long-Term Financial Planning Matters More Than Ever. In today's rapidly changing economic landscape, achieving true financial security requires more than just saving money—it demands a...

25 Sep 2025

Fitness

5 Effective Strategies for Weight Loss

Introduction. Losing weight can be a challenging journey, but with the right strategies, it's entirely achievable. This article explores five effective techniques that can help you shed pounds and...

15 Jul 2025

Cardio vs Strength Training: Which is Better

Understanding the Fundamental Differences. When embarking on a fitness journey, one of the most common dilemmas people face is choosing between cardiovascular exercise and strength training. Both...

23 Sep 2025

How to Stay Fit Without a Gym

Introduction to Staying Fit Without a Gym. In today's fast-paced world, finding time to hit the gym can be challenging. However, staying fit doesn't require expensive equipment or a gym...

17 Jul 2025

The Complete Beginner's Guide to Yoga

Welcome to the World of Yoga. Embarking on a yoga journey can transform your life, offering a path to improved flexibility, strength, and mental clarity. This guide is designed to introduce...

15 Jul 2025

Blogging

How to Start a Successful Blog Today

Introduction to Blogging Success. Starting a blog in 2024 might seem daunting, but with the right approach, it can be a rewarding venture. Whether you're looking to share your passion, establish...

15 Jul 2025

How to Start a Successful Blog Fast

Introduction to Fast-Track Blogging Success. Starting a blog can seem daunting, but with the right approach, you can launch a successful blog quickly. This guide will walk you through the...

17 Jul 2025

How to Start a Successful Blog Quickly

Introduction to Blogging Success. Starting a blog can seem daunting at first, but with the right approach, you can set up a successful blog quickly. This guide will walk you through the essential...

16 Jul 2025

Decor

Easy DIY Home Decor Ideas for Beginners

Simple and Creative DIY Home Decor Projects for Newbies. Embarking on DIY home decor projects can be a thrilling way to personalize your living space without breaking the bank. Whether you're a...

17 Jul 2025

Easy DIY Home Decor Ideas for All

Transform Your Space with These DIY Home Decor Ideas. Looking to refresh your home without breaking the bank? DIY home decor projects are a fantastic way to personalize your space while staying...

15 Jul 2025

Creative DIY Projects for Home Decor

Transform Your Home with These Creative DIY Projects. Looking to add a personal touch to your home decor? DIY projects are a fantastic way to infuse your space with personality and creativity. Not...

16 Jul 2025

Marketing

The Complete Guide to Digital Marketing

Introduction to Digital Marketing. In the ever-evolving digital landscape, mastering digital marketing is crucial for businesses aiming to thrive online. This guide will walk you through the essential strategies and tools needed to excel in digital marketing.. Understanding Digital Marketing. Digital marketing encompasses all marketing efforts that use an electronic device or the internet. Businesses leverage digital channels such as search engines, social media, email, and other websites to connect with current and prospective customers.. Key Components of Digital Marketing. Search Engine Optimization (SEO):. The practice of increasing the quantity and quality of traffic to your website... Read More

15 Jul 2025

Health

The Science Behind Better Sleep Habits

The Importance of Quality Sleep. Quality sleep is foundational to our overall health and well-being. It affects our mood, energy levels, and even our weight. Understanding the science behind...

16 Jul 2025

The Science Behind Effective Weight Loss

Understanding the Fundamentals of Weight Loss. Weight loss is a journey that millions embark on every year, yet many find themselves struggling to achieve lasting results. The science behind...

17 Jul 2025

How to Improve Your Sleep Quality

Introduction to Better Sleep. Sleep is a cornerstone of good health, yet many struggle to achieve restful nights. Improving your sleep quality can enhance your mood, energy levels, and overall...

15 Jul 2025

Biotechnology Breakthroughs That Are Saving Lives

Revolutionary Advances in Biotechnology Transforming Healthcare. In recent years, biotechnology has emerged as a beacon of hope, offering groundbreaking solutions to some of the most pressing...

18 Jul 2025

Technology

Wearable Tech for Athletes: Performance Enhancement

Introduction to Wearable Technology in Sports. In the realm of competitive sports and personal fitness, wearable technology has emerged as a game-changer. These innovative devices are designed to...

19 Jul 2025

The Future of IoT in Everyday Life

The Future of IoT in Everyday Life. The Internet of Things (IoT) is rapidly becoming a cornerstone of modern living, seamlessly integrating into our daily routines to make life more convenient,...

01 Aug 2025

Top Cybersecurity Threats to Watch in 2023

Introduction to Cybersecurity in 2023. As we step into 2023, the digital landscape continues to evolve at an unprecedented pace, bringing with it a new set of cybersecurity threats. Businesses and...

19 Jul 2025

Wearable Technology: Health and Fitness Revolution

The Rise of Wearable Technology in Health and Fitness. In recent years, wearable technology has emerged as a cornerstone of the health and fitness revolution. From smartwatches to fitness bands,...

18 Jul 2025

Travel

The Best Travel Destinations for Adventure Lovers

Discover the World's Most Exciting Adventure Destinations. For those who crave excitement and yearn to explore the unknown, the world is full of breathtaking destinations that promise...

16 Jul 2025

Top 5 Travel Destinations for Adventure Lovers

5 Ultimate Adventure Spots for Thrill Seekers. For those who crave excitement and adrenaline, the world is full of incredible destinations that offer unforgettable adventures. From towering...

15 Jul 2025

The Best Travel Destinations for 2023

Discover the Best Travel Destinations for 2023. As the world opens up, 2023 promises to be a year filled with unforgettable travel experiences. Whether you're seeking serene beaches, bustling...

15 Jul 2025

Recent Post

Agile Methodology in Software Project Management

Introduction to Agile Methodology. Agile methodology has revolutionized the way software projects are managed and delivered. Unlike traditional waterfall approaches that follow a linear,... Read More

26 Sep 2025

Sustainable Computing: Eco-Friendly Hardware Solutions

Embracing Sustainable Computing Through Eco-Friendly Hardware. As digital transformation accelerates globally, the environmental impact of computing infrastructure has become increasingly... Read More

26 Sep 2025

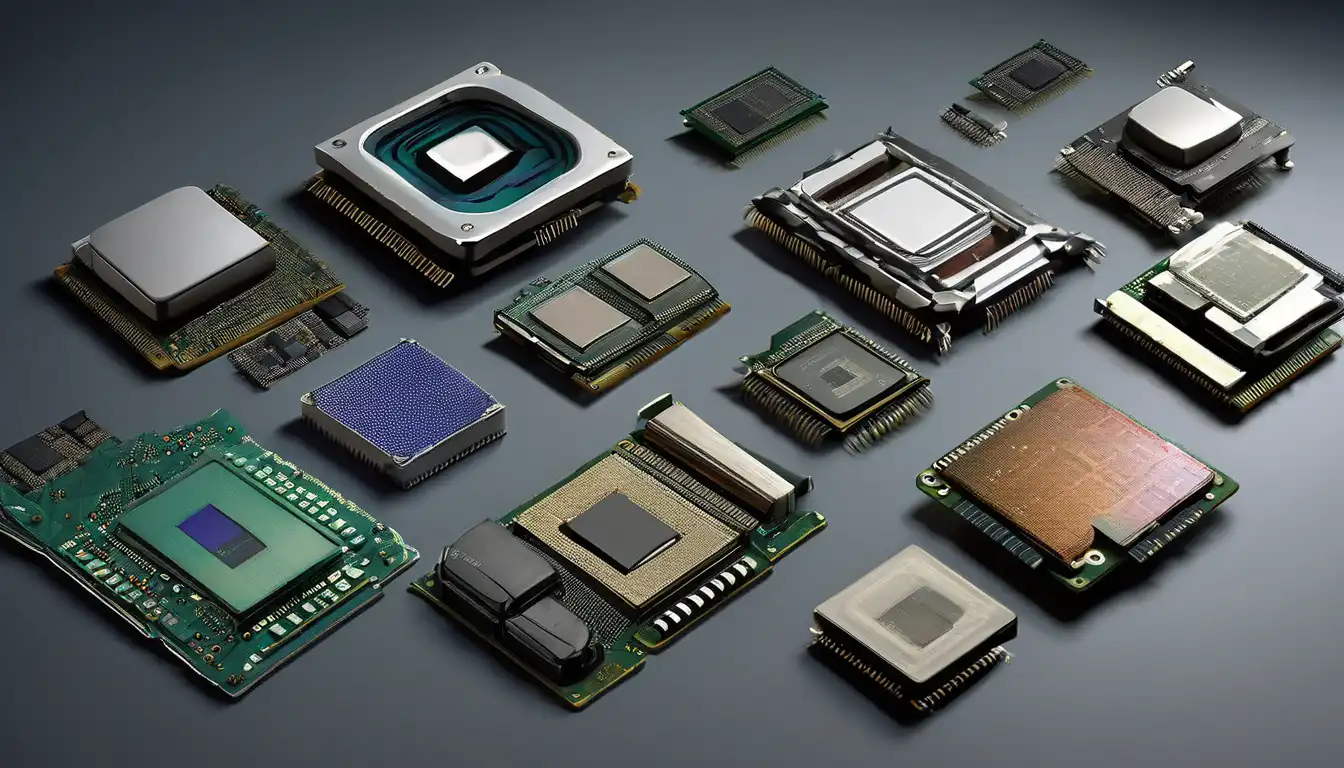

The Evolution of Computer Processors Over Time

The Dawn of Computing: Early Processor Technologies. The evolution of computer processors represents one of the most remarkable technological journeys in human history. Beginning with primitive... Read More

26 Sep 2025

How to Choose the Right Computer Components

Introduction to Computer Component Selection. Building your own computer can be an incredibly rewarding experience, but choosing the right components is crucial for optimal performance and value.... Read More

26 Sep 2025

Building a High-Performance Gaming PC Guide

Introduction to High-Performance Gaming PC Construction. Building a high-performance gaming PC represents one of the most rewarding experiences for gaming enthusiasts. Unlike pre-built systems,... Read More

26 Sep 2025

Latest Innovations in Computer Hardware Technology

Revolutionary Advances in Computer Hardware Technology. The landscape of computer hardware technology is undergoing unprecedented transformation, with innovations emerging at an accelerated pace.... Read More

26 Sep 2025

Machine Learning vs Traditional Programming Approaches

Understanding the Fundamental Differences Between Machine Learning and Traditional Programming. In today's rapidly evolving technological landscape, the distinction between machine learning and... Read More

26 Sep 2025

How to Get Started with Machine Learning Projects

Introduction to Machine Learning Projects. Machine learning has transformed from an academic concept to a practical tool that businesses and individuals use daily. Whether you're a student,... Read More

25 Sep 2025

Practical Applications of Machine Learning in Healthcare

How Machine Learning is Revolutionizing Healthcare Delivery. Machine learning has emerged as a transformative force in healthcare, offering innovative solutions to longstanding challenges. From... Read More

25 Sep 2025

Breaking Down Artificial Intelligence for Beginners

What Exactly is Artificial Intelligence?. Artificial Intelligence, commonly referred to as AI, represents one of the most transformative technologies of our time. At its core, AI involves creating... Read More

25 Sep 2025

🔥 Popular Posts

- Networking Tools for Troubleshooting Connection Issues 17809 views

- Robotics: The Intersection of Technology and Innovation 14506 views

- Understanding the Psychology Behind Gaming Addiction 2990 views

- Machine Learning Algorithms Every Developer Should Know 2189 views

- Artificial Intelligence in Everyday Life: What's Next? 1948 views

- How to Start a Successful Blog Fast 1355 views

- How to Start a Successful Blog Quickly 1330 views

- How to Start a Successful Blog Today 1326 views

- Quantum Computing Applications You Didn't Know About 1107 views

- Biotechnology Breakthroughs That Are Saving Lives 875 views

- Gadgets That Make Your Home Smarter 642 views

- Internet of Things: Connecting the World 639 views

- The Security Challenges of IoT Devices 617 views

- How Smart Gadgets Are Changing Our Lives 606 views

- IoT in Healthcare: A Game Changer 603 views

- DevOps: Bridging the Gap Between Teams 598 views

- The Future of Hardware: What's Next? 597 views

- The Best Tech Gadgets for Productivity 597 views

- DevOps Culture: Collaboration and Efficiency 594 views

- Building a PC: A Beginner's Guide 591 views